Mortgage rates sank to another low for the 12th time this year, according to Freddie Mac, a government-sponsored agency that backs millions of mortgages.

The rate on the 30-year fixed mortgage fell to 2.78%, down from 2.80% last week, which was the previous low on records tracing back to 1971. A year ago, the rate was at 3.69 percent.

“Mortgage rates hit another record low due to economic and political ambiguity,” said Sam Khater, Freddie Mac’s chief economist. “Despite the uncertainty that we’ve all experienced this year, the housing market, buoyed by low rates, continues to be a bright spot.”

While a second wave of coronavirus cases prompted homeowners to look for new properties, high prices will act as a major roadblock, experts noted.

‘The lack of available homes is pushing listing prices considerably higher’

Affordability continues to remain a challenge for many Americans as a lack of inventory remains a persistent problem, exacerbated by the pandemic that is discouraging some sellers to list.

“With a rising second wave of COVID cases, the challenge of social distancing continues to drive peoples’ quest for a housing solution,” Raitu said. “However, the lack of available homes is pushing listing prices considerably higher than a year ago. Steep price gains are placing affordability front and center.”

Experts also noted that rising housing prices may even offset the benefits of historically low mortgage rates.

“For buyers looking to purchase the median-priced home this month, the monthly mortgage payment will be just $8 less than it would have been last year, for a total savings of about $99 per year,” Raitu said.

Meanwhile, «the drop in rates spurred an uptick in demand for refinances,” said Joel Kan, associate vice president of economic and industry forecasting of the Mortgage Bankers Association.

Refinance activity increased 6% last week from the previous week and volumes were 88% higher than a year ago. A total of 68.7 percent of all mortgage activity was refinance-related, up from 66.7% in the previous week, according to the MBA.

Dhara is a reporter Yahoo Money and Cashay. Follow her on Twitter at @Dsinghx.

Otros temas de interés:

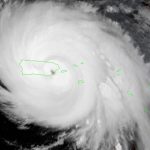

Act 273 Airbnb Alquileres Caribbean Compradores Condominios Covid-19 CRIM Economía Ejecuciones Entertainment Estilo de Vida Eventos Naturales Financiamiento Hipotecario Funny real estate Gobierno Historia home buying Home Safety Home Selling HUD Humor Huracanes Hurricane season Incentivos Inversiones Investments Life lessons Marriage Modern Family Negocios Parenting Phil Dunphy Philosophies Quotes Real Estate REALTOR® Sellers Short Term Rentals Sitcom Testimonials TV Show Vendedores Videos Vivienda